Us hourly wage tax calculator 2019

The average salary for Tax Accountant V at companies like Oncocyte Corp in the United States is 162760 as of August 29 2022 but the salary range typically falls between 140647 and. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

2

Enter your income and location to estimate your tax burden.

. Next select the Filing Status drop down menu and choose which option applies. It can also be used to help fill steps 3 and 4 of a W-4 form. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Find out the benefit. Enter up to six different hourly rates to estimate after-tax wages for. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box.

First enter your Gross Salary amount where shown. US Tax Calculator 201920. Using the United States Tax Calculator is fairly simple.

Estimate your tax withholding with the new Form W-4P. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Our online Hourly tax calculator will. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Import Your Tax Forms And File With Confidence.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Get Started Today with 1 Month Free. This places US on the 4th place out of 72 countries in the.

The US Tax Calculator is an application that allows you to calculate save and print your tax return following simple auto calculating tax forms which mirror the. How do I calculate hourly rate. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. The United States Hourly Tax Calculator for 2022 can be used within the content as you see it alternatively you can use the full page view. The state tax year is also 12 months but it differs from state to state.

Next divide this number from the. Dont Put It Off Any Longer. Ad Time To Finish Up Your Taxes.

All Services Backed by Tax Guarantee. You have nonresident alien status. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Get Your Quote Today with SurePayroll. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. 2019 Hourly Wage Conversion Calculator.

Get Previous Years Taxes Done Today With TurboTax. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. See where that hard-earned money goes - Federal Income Tax Social Security and.

Select your age range from the options displayed. See where that hard-earned money goes - with Federal Income Tax Social Security and other. Even though education quality in the United States lags behind other industrialized countries the degree to which college education influences.

Some states follow the federal tax.

Payroll Tax What It Is How To Calculate It Bench Accounting

Business Budget Templates 15 Printable Excel Word Pdf Budget Template Excel Free Excel Budget Template Business Budget Template

Real Estate Agent Daily Planner Printable Daily Plan Daily Etsy Real Estate Agent Business Plan Real Estate Business Plan Real Estate Tips

Service Invoice Template Invoice Template Invoice Template Word Templates Printable Free

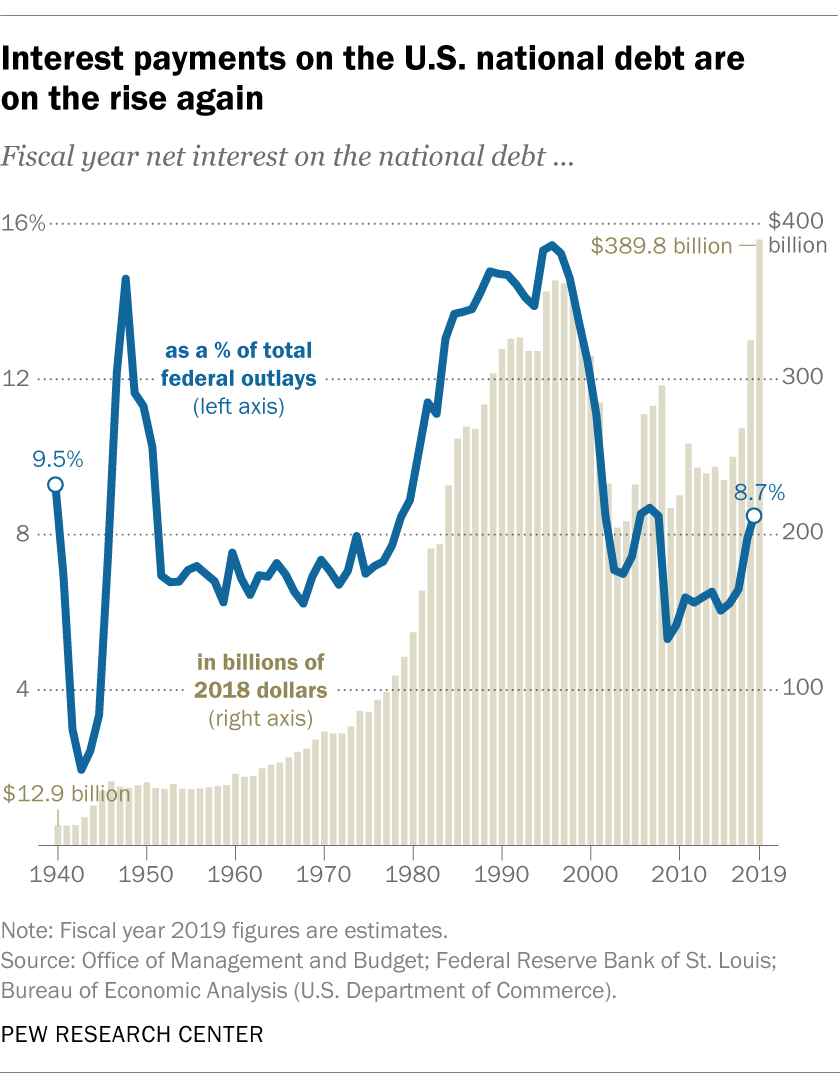

5 Facts About The National Debt Pew Research Center

2019 Salary Budgets Inch Upward Ever So Slightly Budget Forecasting Budgeting Salary

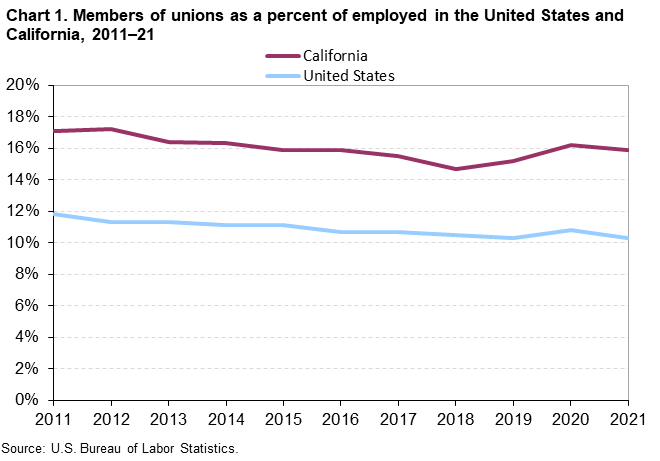

Union Members In California 2021 Western Information Office U S Bureau Of Labor Statistics

Arc Planner Printable Planner Planner

Doximity 2019 Physician Compensation Report

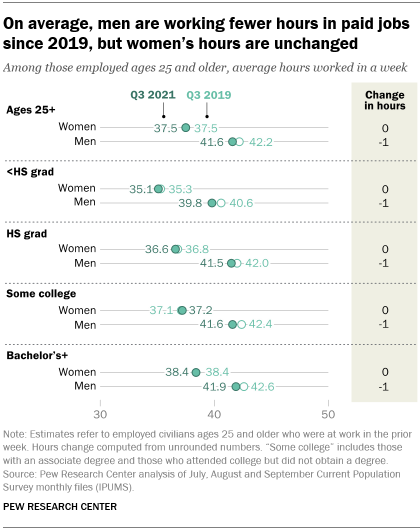

During Pandemic Some Workforce Disparities Between Men Women Grew Pew Research Center

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

23 Employee Timesheet Templates Free Sample Example Format Download Timesheet Template Templates Printable Free Home Health Aide

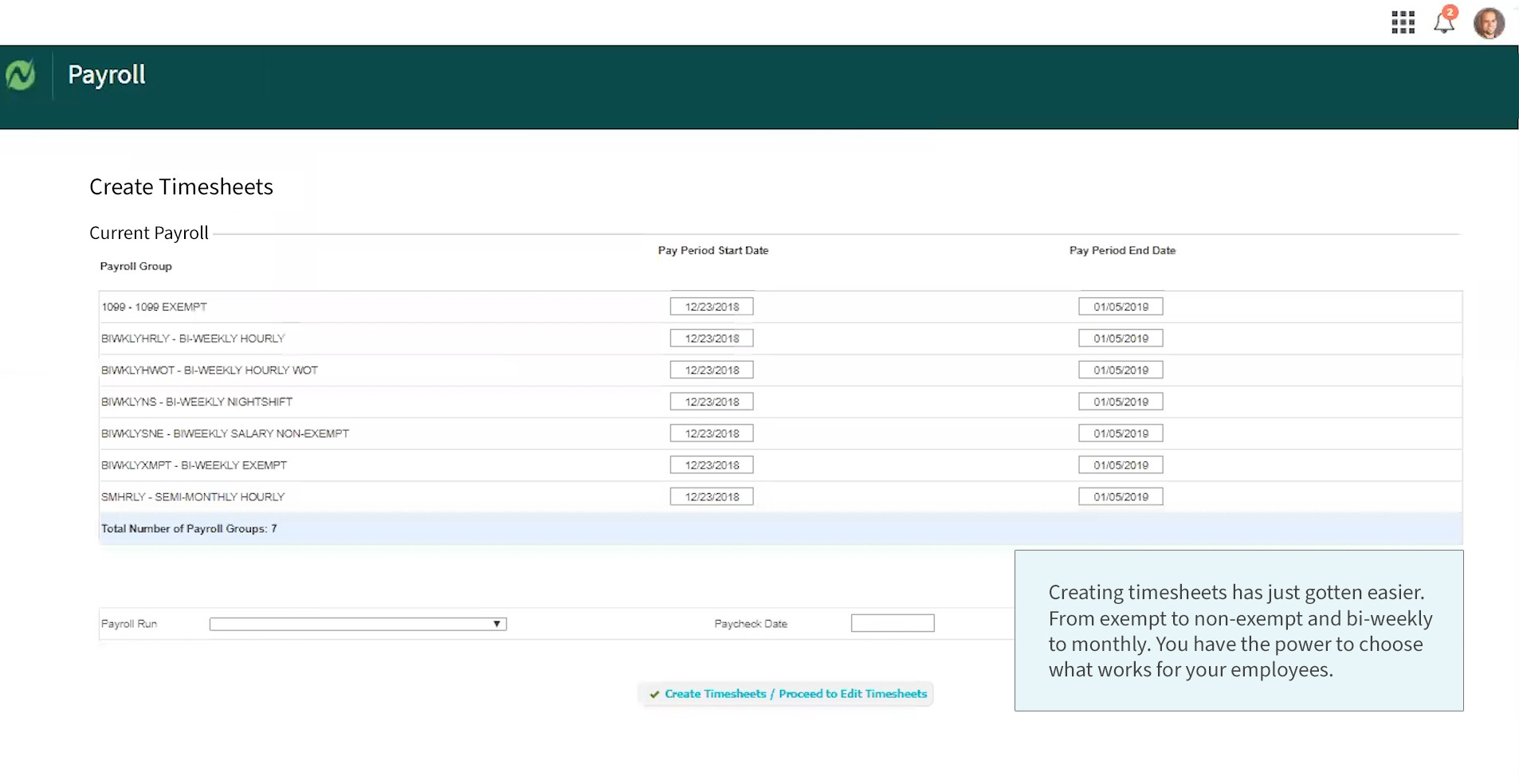

Paycheck Calculator Netchex Payroll Software

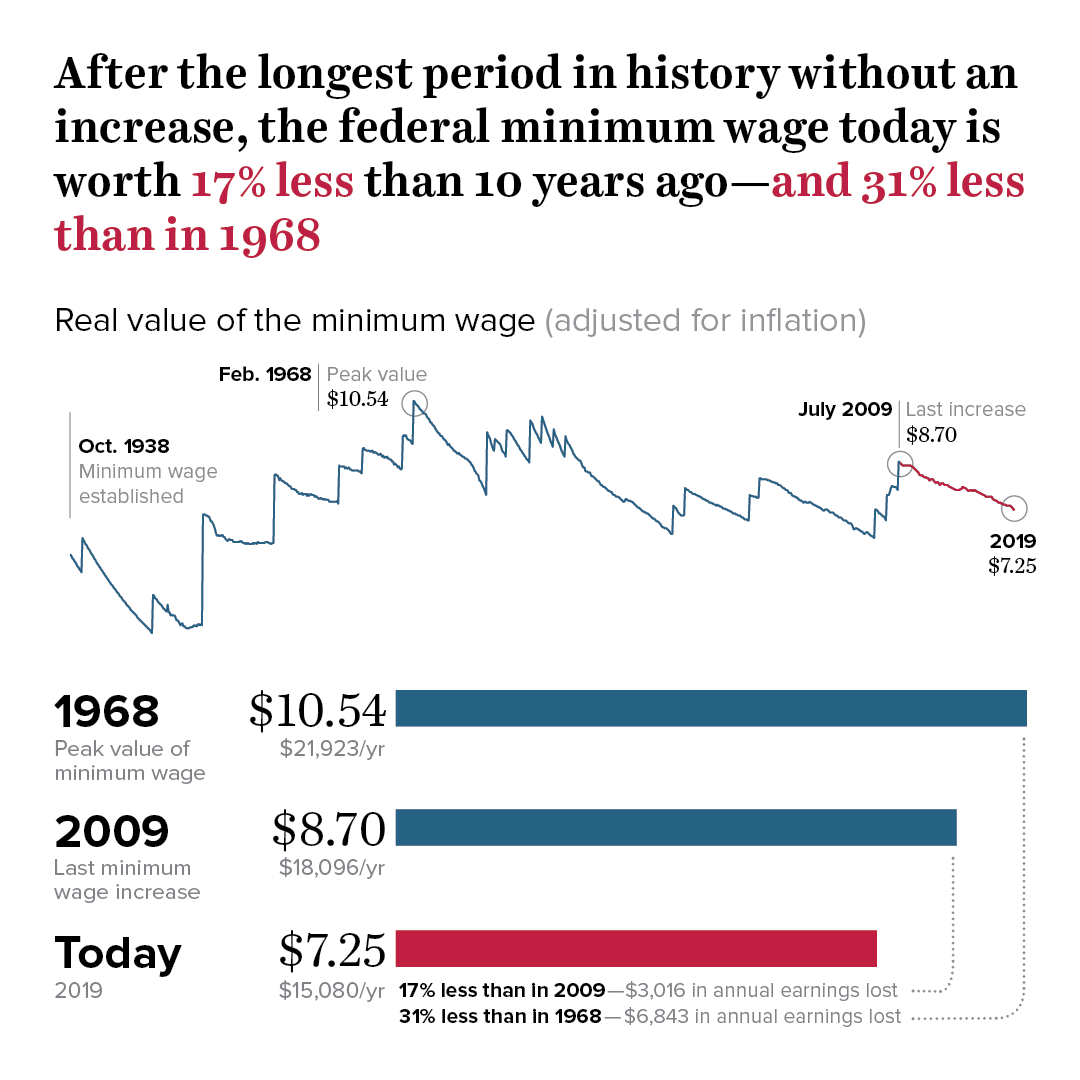

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Child Support Payments

Salary Calculator Spec Teach Chicago